Message from the CEO

Oil&New~Next Stage~

Prioritizing safety, stability,

and economic rationality in

uncertain times

Representative Director,

Group CEO

Shigeru Yamada

Reflecting on my first two years as Group CEO

Valuing continuity and embracing change

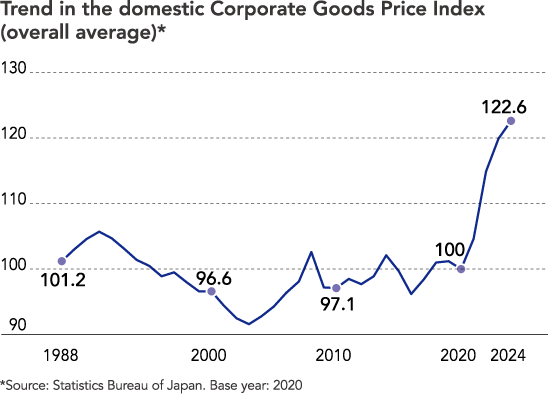

Two years have passed since I assumed the role of Group CEO, coinciding with the launch of the Seventh MTMP. During this time, the business environment surrounding the Cosmo Energy Group has undergone significant changes. Among them, the most notable has been the rapid rise in inflation.

Over the past 37 years since I joined the Company (then Cosmo Oil Co., Ltd.) in 1988, the Japanese economy had, until recently, experienced prolonged deflation. Given the shifting external environment, I believe society as a whole must now reconsider the direction of its policies.

Our Group is committed to selecting and focusing on core businesses, while rigorously managing controllable costs and productivity. For areas where such efforts cannot fully absorb rising costs, we accurately assess the situation and respond swiftly—including, when necessary, seeking the understanding and cooperation of our valued customers.

On the other hand, what remains unchanged is our steadfast commitment to safe operations and a stable supply—something I have consistently emphasized since becoming Group CEO. This focus should continue to guide the Group and also serve as a key source of our competitive advantage.

Although safety and stability are typically associated with manufacturing operations, our Group sees them as essential across our entire value chain—from crude oil development in the Middle East, transportation to Japan, and refining, to the supply of fuel at service stations and the corporate functions that underpin each step. We are committed to enabling all employees to perform their duties safely and with stability, regardless of their role or location.

Ensuring safe operations and a stable supply requires an unwavering daily commitment—it is something we build, step by step. To uphold this standard, it is essential that every employee embraces this mindset. I have consistently stressed this key group priority whenever possible, including in my New Year’s greetings and at welcome ceremonies for new employees. Now two years into my tenure as Group CEO, I increasingly sense, during my visits to various sites, that we are making meaningful progress—not only in the implementation of specific initiatives, but also in the mindset of our employees.

Understanding the business environment and the basis for managerial decisions

Shifts in energy security and transitioning to net zero carbon emissions

As I noted earlier, the business environment surrounding the Group is changing dramatically. Ongoing crises in Ukraine and the Middle East continue to drive geopolitical uncertainty around the world, with no resolution yet in sight. Additionally, with the new U.S. administration’s policies driving significant changes in trade rules, I sense that the global economy is becoming increasingly fragmented.

Japan must respond not only to rapid inflation but also to rising geopolitical risks. Specifically, as the country depends on imports for about 90% of its primary energy, it is essential to further enhance energy security by diversifying and strengthening energy procurement.

Another perspective to consider is the trend towards net zero carbon emissions. While I believe the long-term trajectory toward carbon neutrality remains unchanged, in the short term, rising global inflation has contributed to a slowdown in the renewable energy sector and a return to fossil fuels. These developments are prompting a reassessment of both the timeline for achieving net zero carbon emissions and the role of fossil fuels in ensuring energy security.

Domestically, the Cabinet’s endorsement of the Seventh Strategic Energy Plan and the GX 2040 Vision, as well as ongoing regulatory preparations for the GX-ETS1, highlight the importance of staying attuned to shifts in energy policy.

- GX-ETS (Green Transformation - Emission Trading Scheme): An emission trading scheme conducted under the GX League framework

Sustainable management decision making based on sound economic reasoning

In my view, advancing a business involves a continuous cycle of navigating uncertainty by gathering a broad range of information and variables, envisioning the future, making sound decisions, and strategically investing management resources to realize growth. As obvious as it may seem, we must always remember that economic rationality remains a cornerstone of sound decision making. Given that we are in an era where the outlook is extremely challenging and uncertain, I believe that examining and pursuing economic rationality from multiple perspectives and consistently making decisions without losing sight of this focus are key to enhancing enterprise value. We are committed to fully pursuing economic rationality as a core principle—not only within our current leadership team but also among the next generation of management who will shape the Company’s future.

Management decisions are grounded in a robust governance framework. Our Board of Directors includes independent outside directors who make up half of its members, with women comprising one-third of the Board. This has helped increase the transparency and diversity essential to enhance enterprise value. At Board meetings, directors engage in open discussions that consider shareholders’ perspectives, with outside directors raising many questions and offering valuable insights each time. Thanks to Board reforms in 2022, a greater degree of business execution authority has been delegated to executive officers—enabling faster, more responsive decision making in the face of evolving external conditions.

Progress of the Seventh MTMP and sources of profitability

Record-breaking profits in FY2024

As I conveyed in last year’s integrated report, FY2023—the first year of the Seventh MTMP—saw us take steady steps toward the sustainable enhancement of enterprise value by achieving many of the KPIs we set as targets. In FY2024, the plan’s second year, although some of our New fields initiatives required rethinking, we steadily implemented strategies focused on Oil fields and overall made progress in accordance with the plan. In terms of profits, we were mostly able to attain the targets set for the second year of the three-year medium-term management plan.

Particularly in the Petroleum Business, although the decrease in sales volume was less than we expected, margins remained higher than anticipated. Meanwhile, the refinery operating rate continued to exceed the industry average. As a result, our consolidated ordinary profit (excluding the impact of inventory valuation), which reflects our true profitability, reached an all-time high in FY2024.

Oil fields: Taking efficiency to the next level

In Oil fields, although capital markets had previously viewed us unfavorably due to factors such as declining domestic demand for petroleum products and uncertainties related to the transition toward a carbon-neutral society, we are now steadily earning recognition thanks to our high profitability and strong return-on-investment prospects.

Our foremost competitive advantage in Oil fields is the exceptional efficiency with which we operate. In the Petroleum Business, we strategically reduced supply capacity by shutting down the Sakaide Refinery in 2013, while starting to supply Kygnus Sekiyu in 2019, establishing a short position where sales exceed supply amid declining domestic demand. Building on our established OMS2 practices, we have led the industry in refinery digitization and digital transformation (DX) initiatives. These efforts have enabled us to consistently achieve high uptime and operational efficiency since 2019, outperforming the industry average.

In the Oil Exploration and Production Business, we have built a strong and enduring relationship of trust with the United Arab Emirates (UAE), spanning more than 50 years—dating back to before the country’s founding. The technology, expertise, and experience accumulated over many years of self-operation have enabled low-cost crude oil production. This helped us maintain profitability even when the Dubai crude oil price fell to the $30-per-barrel range, demonstrating our strong competitive edge. In FY2024, we successfully restored oil reservoir pressure at the Hail Oil Field through water injection3—an achievement expected to contribute to increased crude oil production by the Group.

The Petrochemical Business continues to face a prolonged downturn in basic chemical market conditions, driven by structural oversupply from new and expanded large-scale manufacturing facilities in China, alongside the slowdown in the Chinese economy and reduced domestic demand in Japan. In light of these circumstances, in FY2024, we promptly began making improvements to our business structure, including selling our shares in South Korea-based HCP4 and deciding to optimize our production system in the Chiba area.

From an energy security perspective, petroleum remains a vital energy resource. Given that petroleum products are expected to continue accounting for a significant share of energy demand in the foreseeable future, our Group recognizes the importance of increasing efficiency in Oil fields.

At the same time, in order to achieve net zero carbon emissions, we are pursuing energy conservation activities at refineries, which account for a large proportion of GHG5 emissions, and utilizing negative emissions technologies such as CCS6. We are also structurally consolidating facilities in the Petrochemical Business, aiming to reduce GHG emissions across the Group as a whole.

- OMS (Operations Management System): The Cosmo Oil Group’s refinery division has established a policy consisting of 25 requirements as critical items indispensable for achieving safe operations and stable supply. Based on this policy, the head office and refineries are strengthening their respective initiatives and cooperation through the OMS.

- Water injection: A technique that involves injecting water into an oil reservoir to restore declining reservoir pressure at oil fields

- HCP (HD Hyundai Cosmo Petrochemical Co., Ltd.): A joint South Korea-based Petrochemical Business venture established by Cosmo Oil Co., Ltd., a subsidiary of Cosmo Energy Holdings Co., Ltd., and HD Hyundai Oilbank Co., Ltd.

- GHG: Greenhouse Gas

- CCS: Carbon dioxide Capture and Storage

New fields: Balancing net zero carbon emissions and economic rationality

Many aspects of our New fields businesses are closely linked to efforts to reduce GHG emissions and are subject to the influence of global trends and the evolving timeline toward net zero carbon emissions. However, from a holistic perspective, initiatives are progressing smoothly in line with the Seventh MTMP.

Regarding SAF7, a type of next-generation energy, the production line for the mass production of Japan’s first domestic SAF was completed in December 2024. Supply to domestic and international airlines started in FY2025. In 2021, the Group’s SAF business was the first initiative to be selected to as a NEDO-subsidized project8, with the aim of obtaining CORSIA9 certification—a framework approved at the 2016 ICAO10 Assembly. Through collaboration with leading external companies, we have established an end-to-end supply chain that encompasses everything from feedstock procurement to SAF sales. While global regulations and domestic policies in Japan have accelerated SAF adoption, our strength lies in our pioneering role in this field. We are securing contracts with a wide range of customers, including domestic and international airlines as well as cargo carriers.

In the hydrogen area, we entered into a capital and business alliance with industry leader Iwatani Corporation in April 2024 and opened our first hydrogen station in Heiwajima (Ota City, Tokyo) that same month. In March 2025, we opened our second station in Ariake (Koto City, Tokyo), marking steady progress in our joint initiative. Looking ahead to growing future demand for hydrogen, we started exploring the feasibility of hydrogen production and sales businesses, leveraging the assets of Iwatani Corporation and Cosmo Oil’s Chiba Refinery. Iwatani Corporation has built extensive expertise and a robust network in the hydrogen sector over many years. For our Group, this alliance represents a key strength, enabling us to steadily advance our business development in this field.

Lastly, regarding the green electricity supply chain, although we opted not to participate in the offshore wind power project bidding process—based on sound economic reasoning that factored in changes in the business environment—this decision does not call into question the overall integrity of our business model.

In the onshore wind power generation business, Cosmo Eco Power—established as Japan’s first wind power producer and backed by approximately 30 years of experience—has been steadily building up its project portfolio. In electric power sales, our strength lies in operating actual wind power plants and owning green electricity sources. Leveraging this advantage, we are expanding supply to a wide range of customers—including local governments and corporations—through corporate PPAs11 and retail electricity sales via Cosmo Denki (Electricity).

From the outset, we have worked to establish a green electricity supply chain with a focus on 2030 and beyond, making strategic decisions in our offshore wind power generation business aimed at monetization after 2030. However, rising costs driven by rapid inflation and intensifying competition have clearly altered the business environment from what was envisioned when we formulated our medium-term management plan. Building on the progress made thus far during the Seventh MTMP period, we will thoroughly reassess the Group’s assets, development capabilities, and expertise, and proceed with restructuring our strategy.

- SAF: Sustainable Aviation Fuel

- NEDO (New Energy and Industrial Technology Development Organization)-subsidized project: "Establishment of a Supply Chain Model for SAF Production From Domestic Used Cooking Oil" selected in August 2021

- CORSIA: Carbon Offsetting and Reduction Scheme for International Aviation

- ICAO: International Civil Aviation Organization

- Corporate PPA: A long-term purchase agreement between a power producer and a consumer for renewable energy-derived electricity and its environmental value, or for environmental value alone

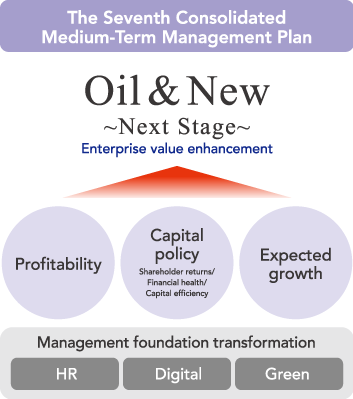

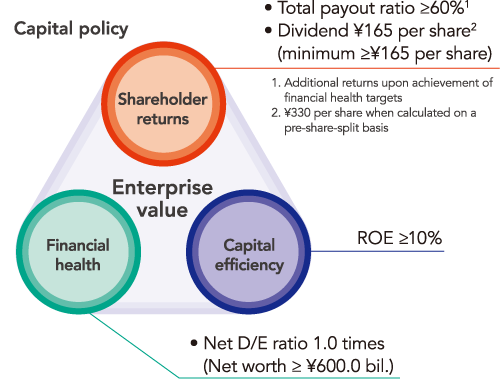

Pursuing a three-pronged capital policy

Alongside profitability, our capital policy is a key pillar in enhancing enterprise value. In the Seventh MTMP, we have established a capital policy based on a three-pronged approach that places equal emphasis on shareholder returns, financial health, and capital efficiency.

In FY2024, our Oil fields businesses led in capital efficiency, achieving a return on equity (ROE) of over 10% for the second consecutive year. Regarding shareholder returns, with solid earnings as a foundation, we are steadily progressing toward achieving a cumulative total payout ratio of 60% or more over a three-year period by increasing dividends per share and conducting share buybacks. When it comes to financial health, although net worth decreased due to business structure improvements and the impact of inventory valuation, we had calculated the necessary net worth to withstand short-term risk fluctuations at the time of formulating the Seventh MTMP, and have been steadily working to build our net worth since then.

Aiming to maximize enterprise value, we remain committed to enhancing profitability while striving to secure appropriate net worth and improve capital efficiency.

Progress in management foundation transformation

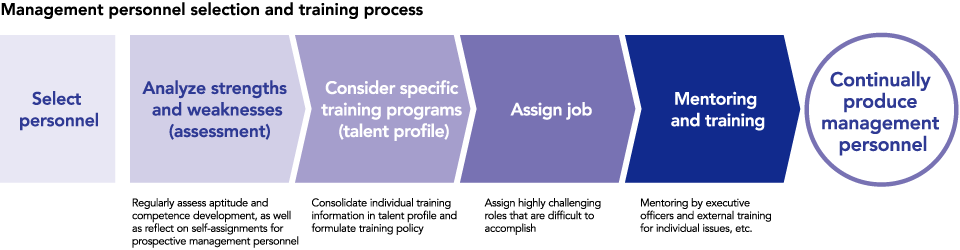

Human resource development is key to sustainably enhancing enterprise value

As I shared upon becoming CEO two years ago, while strong teamwork is one of our Group’s core strengths, I also place great importance on fostering healthy friction through friendly competition within teams, as well as nurturing a strong individual desire for personal growth.

Since then, whenever I have addressed employees, I have consistently encouraged them to embrace positive, healthy friction. While simply communicating this message may not lead to immediate change, I urge them to start wherever they can—even if it’s just revising a single meeting document. If it does not work, they can change it again. Enacting change requires energy. It may invite criticism, and friction may occur. But I believe that pushing through these challenges is what drives the growth of individuals, teams, and ultimately, the Company.

We are also prioritizing investment in human resources to cultivate a strong desire for growth among individual employees. We regard spending on human capital not as a cost, but as a strategic investment. Since FY2023, we have implemented wage increases for three consecutive years—outpacing the private-sector average each year. In addition, we place strong emphasis on education, introducing various programs—including a system where executives serve as mentors to nurture future managerial talent. Specifically, as part of training for newly appointed general managers, we introduced one-on-one presentation sessions with me, the Group CEO, on the final day. This opportunity was well-received by participants, and I believe our collective efforts as a Group are moving decisively in the right direction.

While human resource investment is often viewed primarily in monetary terms, the details matter. It is essential to continuously assess the outcomes—namely, the degree of individual growth—resulting from these efforts. I believe that the development of our people is intrinsically linked to the growth of the Company, and that it is through the growth of each individual employee that we can sustainably enhance enterprise value. Although such investment may not deliver immediate results, I look forward to nurturing the talent that will lead the Group five or ten years from now.

Building a culture of digital transformation

Two years ago, when I assumed the role of Group CEO, I described DX as an area with significant room for growth. Today, I feel confident that we are making tangible progress both in the development of human resources and the realization of DX initiatives.

In the early stages of our DX journey, our efforts primarily focused on improving operational efficiency through the streamlining of workflows and operational reforms. Since then, we have not only digitized our refineries, which directly support safe operations and stable supply, but we have also been working to leverage data to drive revenue growth on the sales and marketing frontlines.

The Group has established an annual program to recognize DX initiatives through Cosmo’s DX Hub12, which supports the resolution of business challenges across various domains. This program not only highlights individual initiatives but also facilitates information sharing and the deployment of ideas across other organizations, reinforcing the sense that DX is deeply embedded in our corporate culture.

- Cosmo’s DX Hub: An in-house program under which a dedicated DX Taskforce supports the implementation of DX project ideas solicited from within the Group, with the goal of accelerating digitization

Aiming for medium- to long-term enterprise value enhancement

Oil fields profit foundation supports initiatives in New fields

Under the Seventh MTMP, which was designed to enhance enterprise value, efforts have been directed toward improving the price book-value ratio (P/B ratio). In FY2024, the P/B ratio remained stable at approximately 1.0 times throughout the year. When the P/B ratio is broken down into its components, return on equity (ROE) multiplied by price-earnings ratio (P/E ratio), I believe we have successfully maintained a strong ROE, although we continue to aim for further improvement. Conversely, the P/E ratio, which serves as an indicator of future growth potential, has been impacted by a challenging business environment in New fields, including uncertainty surrounding the timeline for achieving net zero carbon emissions.

The Group’s profit structure is anchored by highly efficient Oil fields, providing a solid foundation that enables us to pursue opportunities in New fields that involve various forms of risk-taking. It is precisely because of this solid foundation that we are able to take calculated risks in New fields. Moving forward, we will continue to strengthen and refine our core Oil fields businesses to ensure they remain even more robust and resilient. As Group CEO, I am committed to personally communicating our strategy to shareholders and investors whenever possible—particularly during periods of heightened uncertainty in the business environment.

Realizing the Seventh MTMP and looking ahead to the next decade

As previously discussed, the global situation remains highly chaotic, and the management environment continues to grow increasingly uncertain. While the slogans of our Group’s medium- to long-term vision, Vision 2030—"Energy that shapes the future" and "Energy that sustains society"—remain unchanged, we recognize the need to reassess the time horizon for realizing this vision in light of the timeline for achieving net zero carbon emissions and the evolving evaluation of fossil fuels from the perspective of energy security.

In this context, FY2025—the final fiscal year of the Seventh MTMP—will see us firmly generate profits in Oil fields under "Oil & New," just as we envisioned at the time of the plan’s formulation, in order to achieve our MTMP targets. With that in mind, I intend for this to be a pivotal year for thoroughly shaping strategies to drive the Group’s growth over the next decade.

Discussions around the next 10 years are now in full swing. With a focus on global trends and the value our Group can provide in this evolving landscape, we are considering establishing a framework that ensures we stay responsive and resilient—even amid shifts in the external environment.

The Group will soon mark the 40th anniversary since the establishment of Cosmo Oil through a merger. As we approach this milestone, we are committed to further strengthening our foundation of safe operations and stable supply built over the years. At the same time, these increasingly unpredictable times call for us to further enhance enterprise value through sound economic reasoning and cumulative, well-informed decision making.

I look forward to your continued support as the Cosmo Energy Group embarks on its next phase of growth.