Basic Policy regarding Dividend

The Company places particular emphasis on shareholder return.

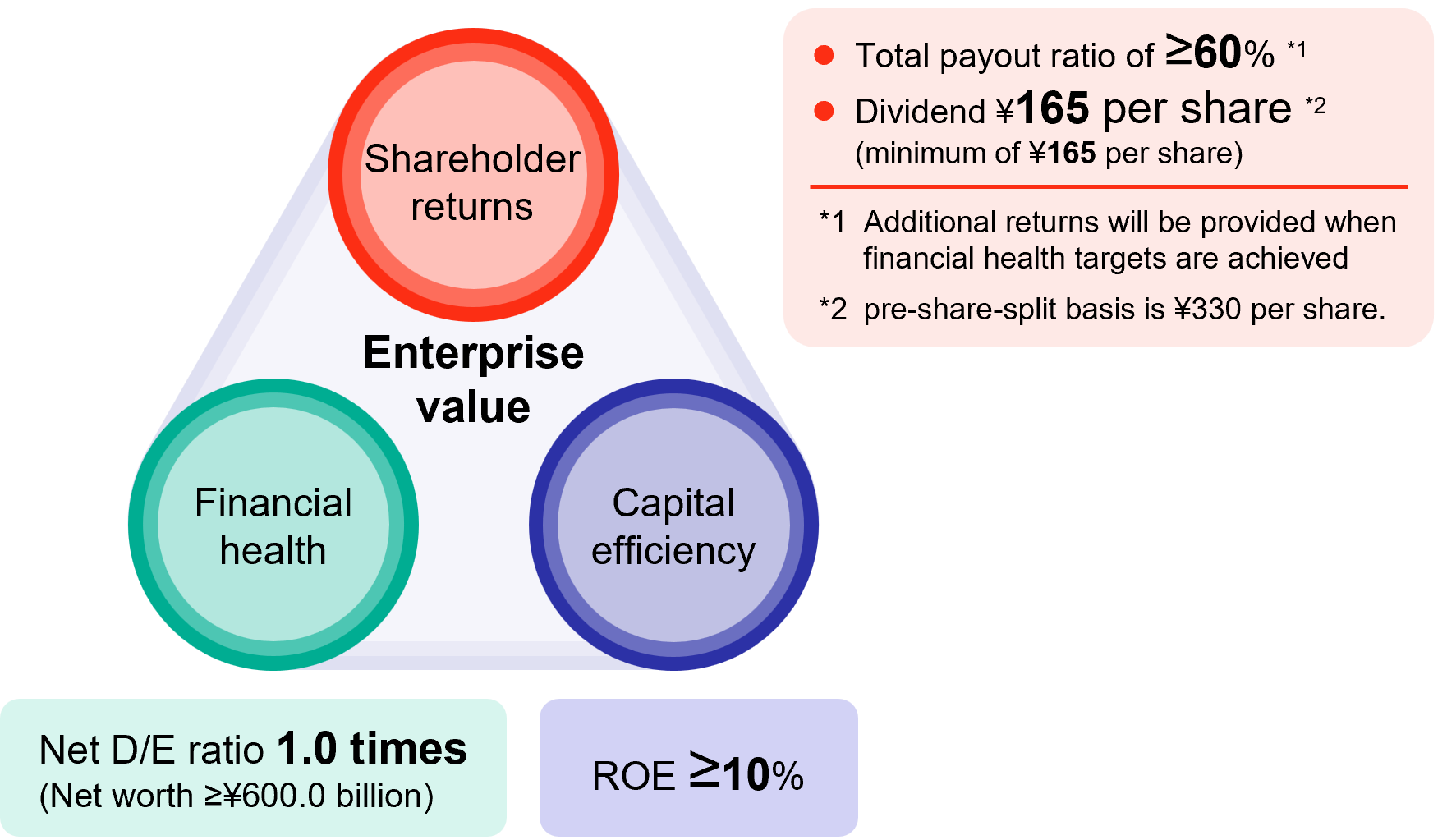

Under the 7th Consolidated Medium-Term Management Plan, we aim to maximize enterprise value through a three-pronged approach that places equal emphasis on shareholder returns, financial health and capital efficiency.

The Company intends to maximize shareholder returns during the 7th Consolidated Medium-Term Management Plan by implementing capital policies, with a payout ratio of at least 60% of net profit excluding impact of inventory valuation (cumulative three-year) and stable dividends of at least 165 yen per share.

In principle, provide additional returns if financial health targets are achieved. Timing of additional returns to be decided during the three-year period of the Med-Term Mgmt. Plan.

*Each common share was split into 2 shares on October 1,2025. The dividend is ¥330 per share on a pre-split basis, with no effective change due to the split.

Dividend History

| Annual dividend per share | |||

|---|---|---|---|

| Interim | Year-end | Full Year | |

| FY2025(Plan) | 150yen | 90yen (¥180 per share on a pre-share-split basis) |

- (¥330 per share on a pre-share-split basis) |

| FY2024 | 150yen | 180yen | 330yen |

| FY2023 | 150yen | 150yen | 300yen |

| FY2022 | 75yen | 75yen | 150yen |

| FY2021 | 0yen | 100yen | 100yen |

| FY2020 | 0yen | 80yen | 80yen |

| FY2019 | 0yen | 80yen | 80yen |

| FY2018 | 0yen | 80yen | 80yen |

| FY2017 | 0yen | 50yen | 50yen |

| FY2016 | 0yen | 50yen | 50yen |

| FY2015 | 0yen | 40yen | 40yen |

| FY2014 | 0yen | 0yen | 0yen |

| FY2013 | 0yen | 2yen | 2yen |

| FY2012 | 0yen | 0yen | 0yen |

| FY2011 | 0yen | 8yen | 8yen |

| FY2010 | 0yen | 8yen | 8yen |

| FY2009 | 0yen | 8yen | 8yen |

| FY2008 | 3yen | 5yen | 8yen |

| FY2007 | 3yen | 5yen | 8yen |

| FY2006 | 3yen | 5yen | 8yen |

| FY2005 | 3yen | 7yen | 10yen |

| FY2004 | 3yen | 5yen | 8yen |

* FY2004-FY2014: Before Transforming to Holding Company System.Upon the establishment of Cosmo Energy Holdings on October 1, 2015, 0.1 shares of common stock in the holding company were allocated and delivered for each share of common stock in Cosmo Oil.

* In FY2005, we paid a dividend for the second half year at ¥7 per share consisting of an ordinary dividend of ¥5 and a bonus dividend of ¥2 to commemorate the 20th anniversary of the merger into the Cosmo Oil Group.

* Each common share was split into 2 shares on October 1,2025.

Acquisition of treasury shares

| Acquisition period | Acquisition method | Total amount acquired | Total number of acquired shares |

|---|---|---|---|

| May 13, 2022 - November 30, 2022 | market purchase | 20 billion yen |

5,313,400 shares |

| May 10, 2024 - March 31, 2025 | market purchase | 23 billion yen |

3,03,100 shares |

| February 7, 2025 - June 30, 2025 | ToSTNeT-3 and market trades on the Tokyo Stock Exchange |

18 billion yen |

2,801,800 shares |

| February 9, 2026 - Mach 31, 2026 | ToSTNeT-3 and market trades on the Tokyo Stock Exchange |

25 billion yen (upper limit) |

6,250,000 shares (upper limit) |

Cancellation of Treasury Shares

| Cancellation Period | Type of shares | Number of Shares | the number of issued shares before the cancellation |

|---|---|---|---|

| Friday, August 29, 2025 | Common shares | 5,832,900 shares | 6.6% |