FY2024 results

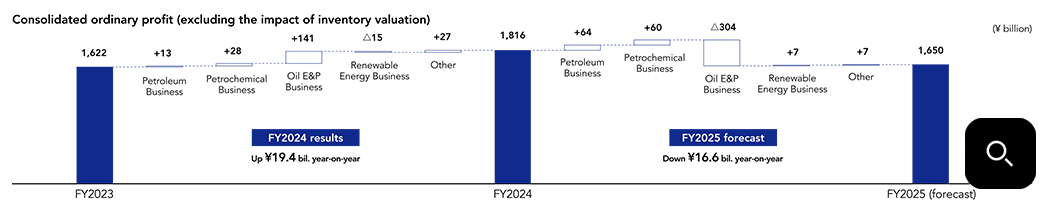

In FY2024, consolidated ordinary profit (excluding the impact of inventory valuation) hit an all-time high of ¥181.6 billion, while profit attributable to owners of parent (excluding the impact of inventory valuation) totaled ¥79.2 billion.

By segment, ordinary profit in the Petroleum Business came to ¥92.6 billion (up ¥1.3 billion year on year), supported by solid domestic margins. In the Petrochemical Business, despite improvements from the previous fiscal year, market conditions remained sluggish, particularly for ethylene, resulting in ordinary profit of negative ¥5.0 billion (up ¥2.8 billion year on year). In the Oil Exploration and Production Business, factors such as the depreciation of the Japanese yen contributed to ordinary profit of ¥82.4 billion (up ¥14.1 billion year on year). In the Renewable Energy Business, due to deteriorating wind conditions and other factors, ordinary profit totaled ¥1.3 billion (down ¥1.5 billion year on year).

FY2025 forecast

In FY2025, consolidated ordinary profit (excluding the impact of inventory valuation) is projected to total ¥165.0 billion, while profit attributable to owners of parent (excluding the impact of inventory valuation) is forecast to reach ¥84.0 billion.

By segment, while costs are expected to rise in the Petroleum Business, continued solid domestic margins and improved refinery operating rates are projected to result in ordinary profit of ¥99.0 billion (up ¥6.4 billion year on year). In the Petrochemical Business, as market conditions continue to soften, ordinary profit is forecast to increase to ¥1.0 billion (up ¥6.0 billion year on year), reflecting the effects of business structure improvements. In the Oil Exploration and Production Business, despite the ramping up of production at the Hail Oil Field, ordinary profit is projected to decline to ¥52.0 billion (down ¥30.4 billion year on year) due to the impact of crude oil prices and foreign exchange rates. In the Renewable Energy Business, ordinary profit is forecast to increase to ¥2.0 billion (up ¥0.7 billion year on year) as a result of the commencement of operations at new sites.

In closing

In FY2024, while steadily implementing the initiatives outlined in our medium-term management plan—such as improving refinery operating rates, starting to increase output at the Hail Oil Field, and commencing operations of the SAF production unit—we also responded flexibly to changes in the business environment, including making structural improvements in the Petrochemical Business and deciding to forgo participating in the third round of bidding for offshore wind power projects. As a result, we achieved record-breaking consolidated ordinary profit (excluding the impact of inventory valuation).

FY2025 marks the final year of the Seventh Consolidated Medium-Term Management Plan. Under the plan’s main theme of enterprise value enhancement, Group companies will make concerted efforts to achieve all targets set forth in the plan.