Cosmo Energy Holdings has adopted a “company with an audit and supervisory committee” governance structure and has appointed an Audit and Supervisory Committee and an accounting auditor. Additionally, we have established a Nomination and Remuneration Committee as a voluntary body to ensure objectivity and transparency in the selection and remuneration determination processes for directors and executive officers.

Executive Remuneration Plan

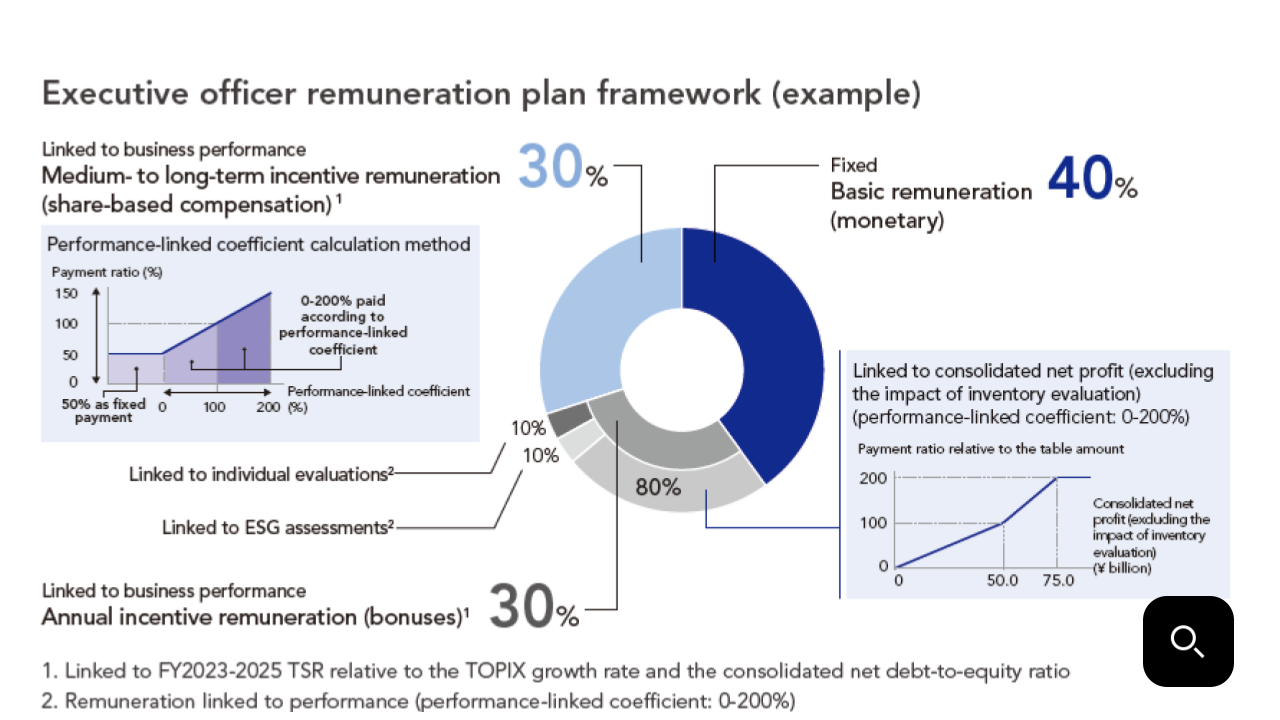

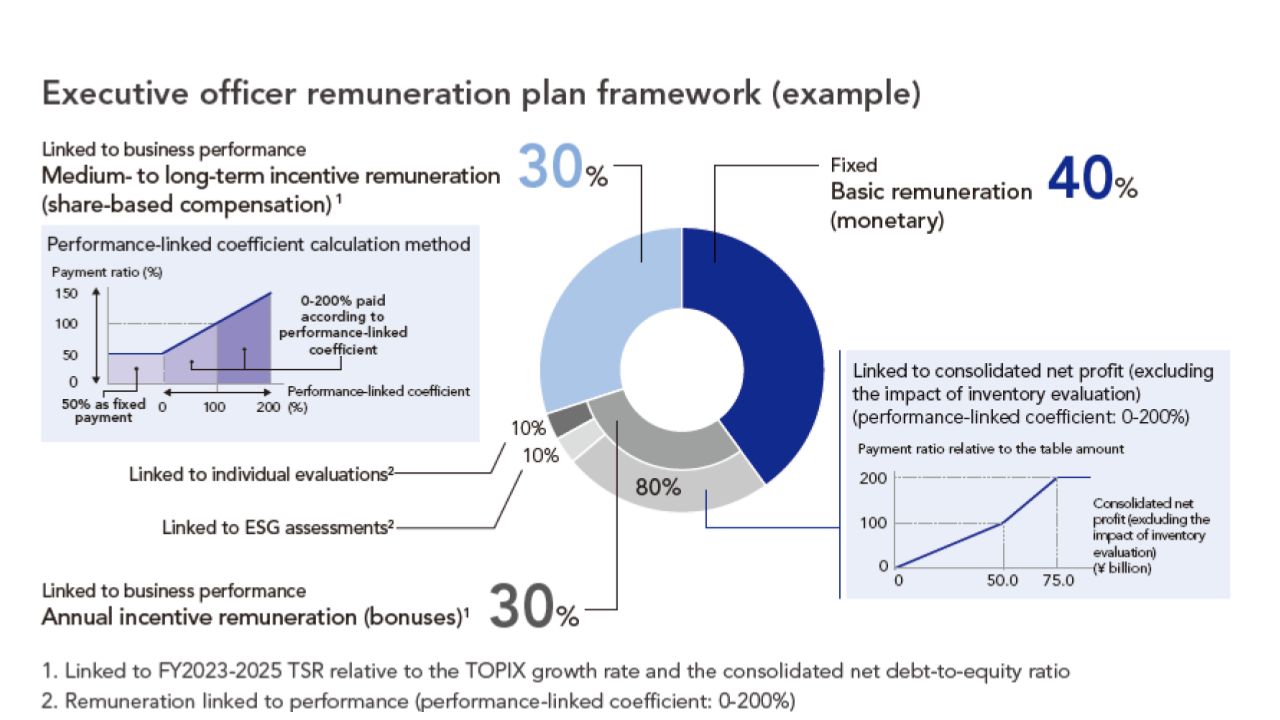

The Company has adopted a performance-linked remuneration plan for directors (excluding outside directors and directors who are members of the Audit and Supervisory Committee) and executive officers. This plan is designed to improve medium- to long-term business performance, provide incentives for enhancing enterprise value and increasing shareholder value, sustainably share economic interests with shareholders, encourage a willingness among directors and executive officers to take on challenges, and ensure transparency and objectivity in the remuneration determination and performance evaluation processes.

Under this plan, remuneration is composed of three parts: basic remuneration, which is monetary remuneration; annual incentive remuneration; and non-monetary medium- to long-term incentive remuneration. The levels are competitive compared to those of leading domestic companies, and the weight of management responsibility is reflected in the higher percentage of incentive remuneration in the remuneration of higher-ranked executives.

The remuneration for outside directors, non-executive directors and directors who are members of the Audit and Supervisory Committee is limited to basic remuneration as a fixed salary, for reasons such as the fact that they do not perform business execution, or that they need to be able to properly fulfill their supervisory role.

Incentive Plans

Annual incentive remuneration

Annual incentive remuneration is based on the evaluation of Group business performance, ESG evaluations, and individual evaluations determined each fiscal year by the Nomination and Remuneration Committee. To ensure consistency with the shareholder return policy announced in the Seventh Consolidated Medium-Term Management Plan, performance evaluations are now conducted based on consolidated net profit (excluding the impact of inventory valuation). Beginning in FY2022, ESG evaluations have been incorporated in remuneration in an effort to foster an environment that motivates directors and executive officers to address material issues promptly and earnestly, thereby promoting sustainable management.

Medium- to long-term incentive remuneration

Medium- to long-term incentive remuneration is provided in the form of a performance-linked share-based compensation plan that is non-monetary in nature. An incentive plan is established every year and evaluated over three consecutive business years in consideration of the execution of duties during the applicable business execution period. For each executive officer eligible under this system, 50% of the basic points defined for each position will be awarded based on performance and the remaining 50% based on other factors. The performance-linked coefficient is determined based on the Company's total shareholder return (TSR) relative to the Tokyo Stock Price Index (TOPIX) growth rate and the consolidated net debt-to-equity ratio.

Stock ownership guidelines

To ensure that value is shared sustainably with all stakeholders, we have established stock ownership guidelines for the Group's executive officers, which took effect in FY2023. Including potential stock holdings (the non-performance-linked portion of basic points granted through medium- to long-term incentive remuneration), the Group chairperson and the CEO will receive 1.5 times their annual basic remuneration within five years of assuming their respective positions. For other executive officers of the Group, the goal is a standard holding value equivalent to annual basic remuneration within five years of assuming their respective positions.

Remunerration to Directors (Total remuneration related to the fiscal year 2024)

| Category | Number of Recipients (Persons) | Amount of Remuneration (Millions of yen) | Basic Remuneration (Millions of yen) | Performance- Linked Remuneration (Yearly Incentive) (Millions of yen) | Performance- Linked Non-Monetary Remuneration (Medium- to Long-Term Incentives) (Millions of yen) |

|---|---|---|---|---|---|

Directors (Excluding Members of the Supervisory Committee) | 9 | 554 | 253 | 251 | 50 |

(Of which Outside Directors) | (3) | (43) | (43) | (-) | (-) |

Directors (Members of the Supervisory Committee) | 5 | 92 | 92 | - | - |

(Of which Outside Directors) | (3) | (54) | (54) | (-) | (-) |

Total | 14 | 647 | 346 | 251 | 50 |

| (Notes) 1. | Of the remuneration etc. above, the amount of remuneration etc. for Directors (excluding those who are Members of the Supervisory Committee) includes the amount of performance-linked remuneration (yearly incentive) for the fiscal year under review and the amount of expenses booked for medium- to long-term incentives related to performance-linked non-monetary remuneration for the Applicable Evaluation Period which includes the fiscal year under review. |

| 2. | The total amount of remuneration, etc. for Directors does not include the salaries paid as the employee portion for the Directors who also work as employees. |

| 3. | At the 9th Ordinary General Meeting of Shareholders held on June 20, 2024, it was resolved that the amount of monetary remuneration for Directors (excluding those who are Members of the Supervisory Committee) would be set at no more than ¥1,000 million per year (including no more than ¥200 million per year for Outside Directors), not including the salaries paid as the employee portion for the Directors who also work as employees. With regard to the number of persons eligible at the conclusion of said General Meeting, the number of Directors that received basic remuneration was eight (8) persons (including three (3) Outside Directors), and the number of Directors that received yearly incentives was four (4) persons (including zero (0) Outside Director). |

| 4. | At the 9th Ordinary General Meeting of Shareholders held on June 20, 2024, it was resolved that the amount of monetary remuneration for Directors who are Members of the Supervisory Committee would be set at no more than ¥200 million per year. At the conclusion of said General Meeting, the number of Directors who are Members of the Supervisory Committee was four (4) persons (including three (3) Outside Directors). |

Fiscal 2024 Nomination and Remuneration Committee’s Activities

In fiscal 2024, the Nomination and Remuneration Committee met nine times and primarily discussed the following agenda items.

| Meeting date | Matters deliberated/reviewed | Matters deliberated/reviewed |

|---|---|---|

| April 23, 2024 |

|

|

| May 13, 2024 |

|

|

| June 10, 2024 |

|

|

| June 20, 2024 |

| |

| July 24, 2024 |

| |

| September 24, 2024 |

| |

| November 12, 2024 |

|

|

| January 21, 2025 |

|

|

| March 26, 2025 |

|

|